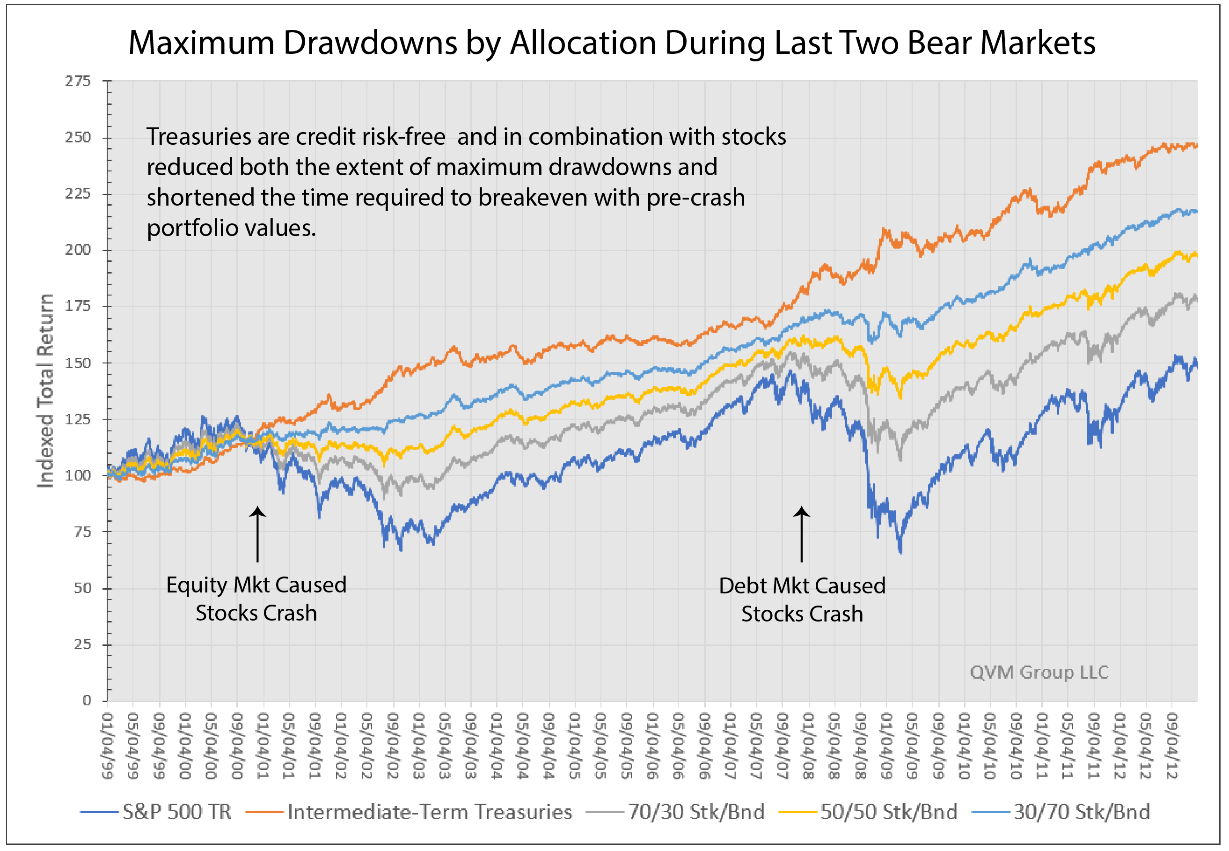

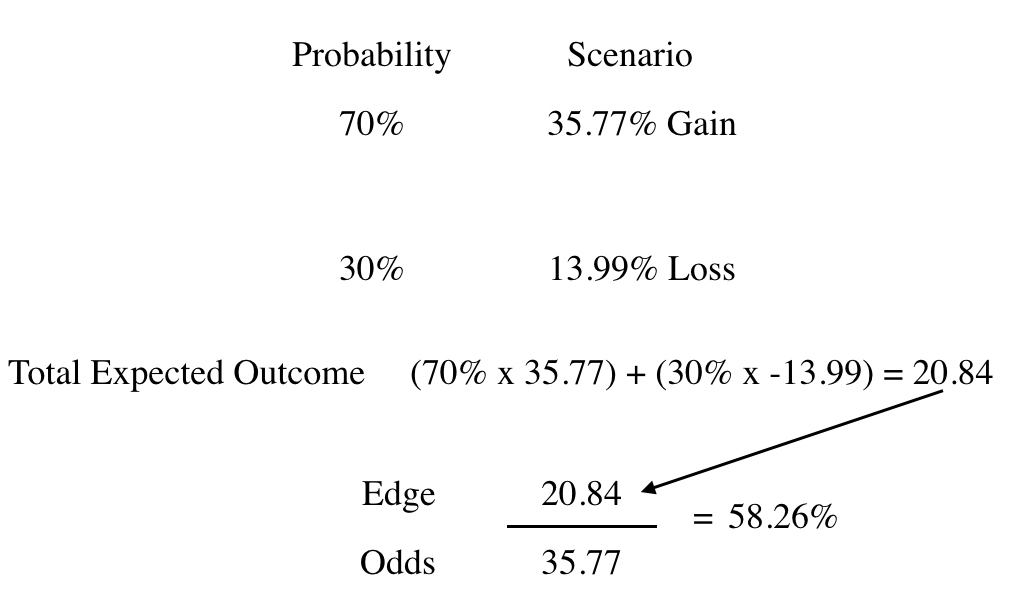

To that end, there is little regard to whether a cryptocurrency investment strategy is valid in the long run, with high expected risk adjusted return, if cryptocurrency investment managers cannot adequately manage drawdowns in the short to medium term, they may not survive in the business at all. Cryptocurrency hedge funds post-2018ĭuring the heady days of the cryptocurrency bull run of 2017 and early 2018, when Bitcoin hit US$20,000, many cryptocurrency hedge funds were just setting up shop and inundated with clients, in what can only be described as a bad case of FOMO (fear of missing out).īut given the massive drawdowns that many long-biased cryptocurrency hedge funds have experienced since then, it comes as no surprise that many either closed up or have had to return capital to their investors, with mere cents on the dollar to show for it.Īs cryptocurrencies roared back to life this summer, managing these drawdowns and indeed managing long-biased cryptocurrency investment strategies is key to successfully navigating the risk-fraught waters of cryptocurrency markets.Īnd while early cryptocurrency hedge fund investors may have been quite content to accept lock-ins, given what had happened in 2018 to cryptocurrency prices, it is evident that moving forward, drawdowns need to be actively managed for investors to even re-consider cryptocurrencies as part of their investment portfolios. Which is why managing drawdown, especially for cryptocurrency hedge funds is so significant. The common definition of drawdown of a portfolio is the percentage loss of current wealth (W t) from a prior all-time high (M t) and can be expressed as DD t = 1 - W t / M t.īecause media attention tends to focus purely on the profit potential from cryptocurrencies when they are rising, it is important, especially for cryptocurrency hedge funds geared for long term survivability, to consider the drawdown risks and manage those accordingly.Ī portfolio’s downside risk of a prolonged drawdown matters not only to the investors’ financial wellbeing, but also to an investment manager’s business survival in the immediate term. Yet it is also a critically important measure for investment management.

The sort that ought only be repeated in hushed whispers and kept away from polite conversation. In the fund business, “drawdown” is a dirty word. In this article, Patrick Tan, CEO of Novum Technologies, explains why cryptocurrency investment drawdowns have become so important and adapts traditional drawdown minimisation techniques to the nascent cryptocurrency market. Have you been paying attention to your drawdowns? If you’re managing cryptocurrency hedge funds, monitoring your drawdown risk can make a big difference to your business’ survival.

0 kommentar(er)

0 kommentar(er)